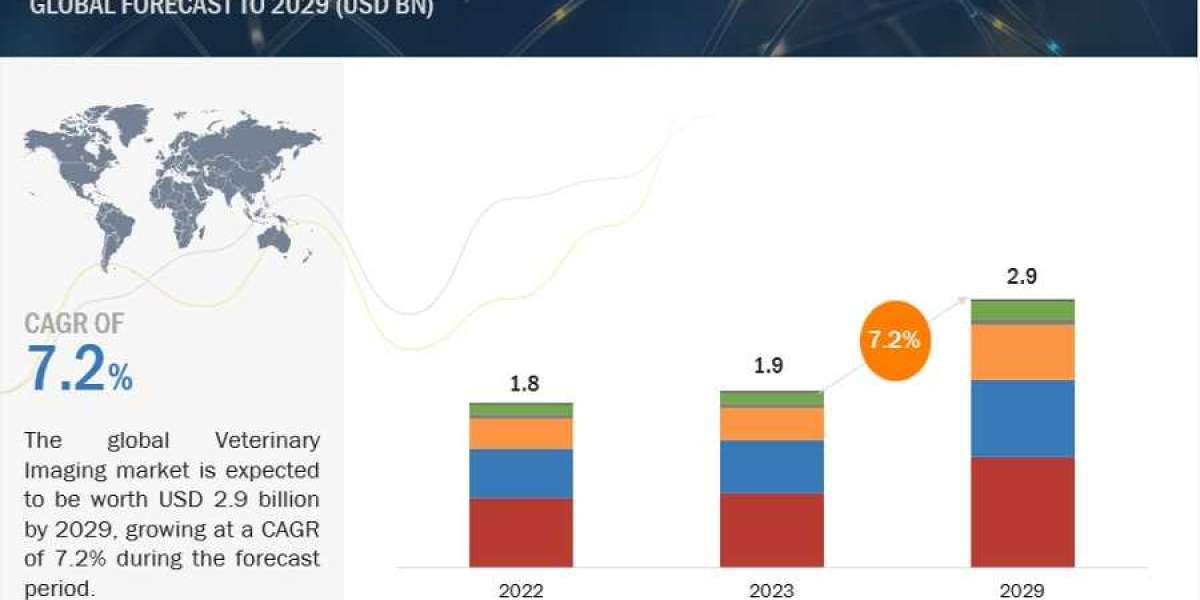

The global Veterinary Imaging Market in terms of revenue was estimated to be worth $1.9 billion in 2023 and is poised to reach $2.9 billion by 2029, growing at a CAGR of 7.2% from 2023 to 2028. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. Rising pet ownership, increased pet insurance penetration, and growing awareness of animal health are driving demand for accurate diagnoses. Innovation is key, with advancements like AI-powered image analysis, portable ultrasound machines, and cloud-based storage improving accessibility and affordability. Telemedicine is also gaining traction, enabling remote consultations and expert collaboration. However, challenges remain, including high equipment costs and limited access to specialists in rural areas. By addressing these barriers and embracing technological advancements, the veterinary imaging market has the potential to revolutionize animal healthcare and improve countless animal lives.

Download a FREE Sample Report PDF of the Global Veterinary Imaging Market Research Report at https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=80889726utm_source=Ganeshutm_medium=P

The prominent players in the veterinary imaging market are GE Healthcare (US), Agfa-Gevaert N.V. (Belgium), Carestream Health (US), Esaote S.p.A (Italy), IDEXX Laboratories, Inc. (US), Mindray Medical International Limited (China), Canon Inc. (Japan), Heska Corporation (US), Siemens Healthineers (Germany), FUJIFILM Holdings Corporation (Japan), Konica Minolta Inc. (Japan), Samsung Electronics Co., Ltd. (South Korea), E.I. Medical Imaging (US), IMV imaging (UK), SEDECAL (Spain). These players include high shares in the market due to strategic mergers, acquisitions, partnerships, and large distribution channels adopted by them. This also leads to an increase in their geographic reach.

The research report categorizes the veterinary imaging market to forecast revenue and analyze trends in each of the following submarkets:

By Product

- Veterinary Imaging Instruments

- Radiography (X-RAY) Imaging Systems

- Computed Radiography Systems

- Direct Radiography Systems

- Film-based Radiography Systems

- Ultrasound Imaging Systems

- 2D Ultrasound Imaging Systems

- 3D/4D Ultrasound Imaging Systems

- Doppler Ultrasound Imaging Systems

- Computed Tomography Imaging Systems

- Stationary Multi-slice Computed Tomography Systems

- Portable Computed Tomography Systems

- Video Endoscopy Imaging Systems

- Magnetic Resonance Imaging Systems

- Other Imaging Systems

- Veterinary Imaging Reagents

- X-RAY and CT Contrast Reagents

- MRI Contrast Reagents

- Ultrasound Contrast Reagents

- Veterinary Imaging Software

By Modality

- Stationary Instruments

- Portable Instruments

By Animal Type

- Small Companion Animals

- Large Animals

- Other Animals

By Application

- Orthopedics and Traumatology

- Obstetrics Gynecology

- Oncology

- Cardiology

- Neurology

- Dentistry

- Other Applications

By End User

- Veterinary Clinics and Diagnostic Centers

- Veterinary Hospitals and Academic Institutions

By Region – Global

The Radiography (X-Ray) Imaging Systems segment accounted for the largest share of the veterinary imaging industry.

The veterinary imaging market in veterinary imaging is undergoing a digital transformation, with trends like flat panel detectors replacing traditional film for faster image acquisition and reduced radiation dose for pets. AI-powered image analysis tools are automating bone fracture and lung disease detection, improving diagnostic accuracy while reducing workload for veterinarians.

Cloud-based image sharing platforms are enabling remote consultations and specialist collaboration, overcoming geographical barriers to care. Additionally, portable and miniaturized X-ray systems are increasing accessibility, particularly in rural areas. Companies developing advanced AI algorithms, user-friendly cloud platforms, and compact, rugged X-ray systems can capitalize on this evolving market, ensuring efficient, accurate, and accessible X-ray imaging for all animals..

The orthopedics and traumatology segment accounted for the largest share in the veterinary imaging industry.

The veterinary imaging market for orthopedics and traumatology is experiencing growth, driven by rising pet obesity, active lifestyles, and increased awareness of early intervention in musculoskeletal issues. Miniaturized and portable X-ray systems are enabling on-site diagnoses at agility events and rural areas, while advanced 3D CT and MRI scans are revealing intricate bone fractures and ligament tears with unparalleled accuracy. AI-powered image analysis is further streamlining workflows, automating fracture detection, and predicting fracture healing potential. These advancements are paving the way for minimally invasive surgical techniques, reducing recovery times for pets. Companies offering mobile imaging solutions, AI-integrated fracture analysis platforms, and specialized orthopedic imaging software can capture this lucrative market, ensuring faster, more accurate diagnoses and improved treatment outcomes for furry athletes and accident victims alike.

The Stationary Instruments segment accounted for the largest share of the veterinary imaging industry.

The stationary veterinary imaging market, though facing competition from portable options, is evolving to offer enhanced precision and in-depth diagnostics. Advancements like dual-energy X-ray systems for differentiating soft tissues and bone, and cone-beam CT (CBCT) for detailed 3D dental and spinal imaging, are driving demand for specialized stationary instruments. AI-powered image analysis is further streamlining diagnoses by automating lesion detection and tumor segmentation, improving accuracy and workflow efficiency.

Direct Purchase of the Global Veterinary Imaging Market Research Report at https://www.marketsandmarkets.com/Purchase/purchase_reportNew.asp?id=80889726utm_source=Ganeshutm_medium=P

Additionally, remote image sharing and cloud-based data storage are facilitating specialist consultations and collaborative care, overcoming geographical limitations. Companies developing AI-integrated analysis tools, user-friendly cloud platforms, and advanced stationary imaging systems with increased affordability and automation can capture this evolving market, ensuring accurate, in-depth diagnoses and improved patient care even in resource-constrained settings.

North America is expected to account for the largest share of the veterinary imaging industry.

The veterinary imaging market is segmented into North America, Europe, Asia Pacific, Latin America, the Middle East and Africa and GCC countries. In 2022, the North American region accounted for the largest share of the market. Government initiative to boost the adoption of advanced technology like veterinary imaging, increased healthcare expenditure, and a rise in veterinary healthcare research, is expected to boost the market in this region. Additionally, North America's strong research and development capabilities foster innovation in the sector.