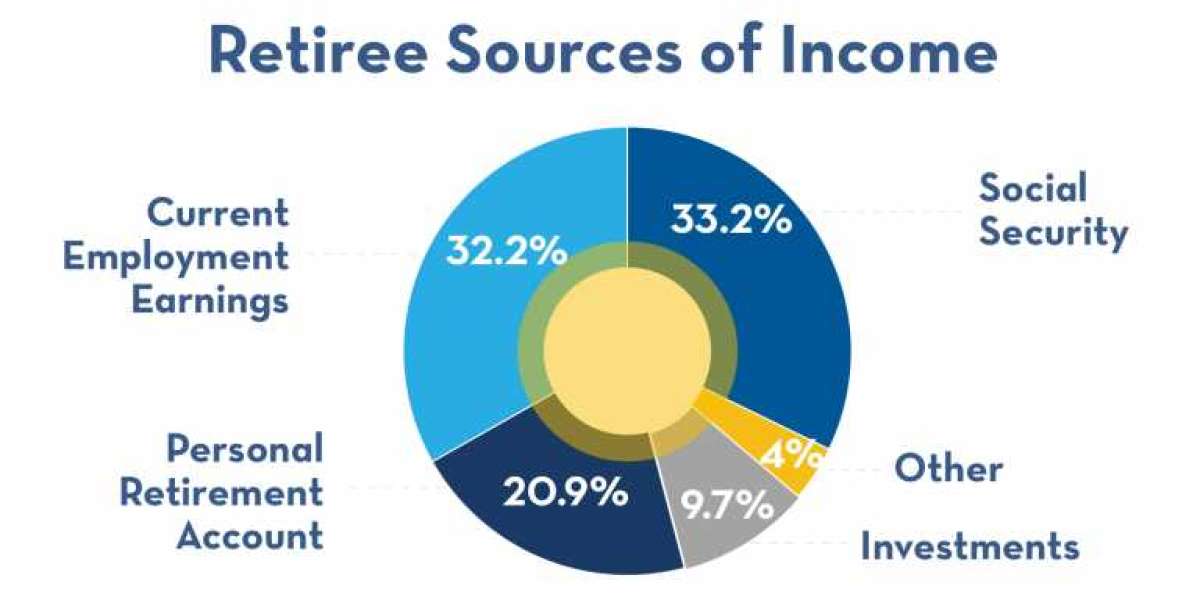

In order to maintain your standard of living after retirement, you will need to generate enough income to avoid exposing your assets to undue risk. There are several ways for retirees to generate income, including 401(k) or 403(b) retirement savings accounts, social security payments, which are a major source of cash, and some retirees are fortunate enough to have a defined-benefit pension, which is becoming increasingly rare and pays out on a regular basis.

When you retire, here are ten additional strategies for generating consistent income while minimizing risk.

1. Immediate Fixed Annuities (also known as "immediate fixed annuities").

A fixed annuity, which provides income with the predictability of Social Security or a pension, can be purchased from a financial institution such as an insurance company. An income-guaranteed contract for a specified period of time or for the rest of your life is described as follows:

As the term "immediate" implies, the insurer begins paying you almost immediately, usually within a month of purchase and then on a monthly basis thereafter.

Annuities, on the other hand, are complicated. A potential risk of investing in an annuity is that you may not live long enough to receive a sufficient number of payments to make the investment worthwhile. A fixed annuity also exposes you to the risk of inflation, especially if it will continue to pay out for many years after it is purchased today.

When purchasing an immediate fixed annuity, you can be assured of receiving income/cash flow for the rest of your life. Unfortunately, you have no way of knowing how much that 'guaranteed' income will be worth," says Dan Stewart, CFA®, president and chief investment officer of Revere Asset Management, Inc. in Dallas, Texas.

You can also compare what you might receive from an immediate variable annuity, in which your payouts are tied to an index to see if they are comparable.

2. Withdrawals on a regular basis

Because annuities typically do not allow you to get your money back once they begin paying out, you might want to consider an investment account with a systematic withdrawal plan instead. A plan of this nature can be established in both retirement and non-retirement account categories. You instruct the investment company on how much money to distribute to you on a monthly, quarterly, or annual basis, depending on your preference. You retain control over your funds, but you do not benefit from the guaranteed income provided by an annuity.

"The liquidity of a systematic withdrawal plan versus an annuity is the most significant difference between the two." Once you have paid your insurance premium to the insurance company, you will no longer be able to access your funds. According to Kevin Michels, CFP® of Medicus Wealth Planning in Draper, Utah, "by developing a systematic withdrawal plan, you'll always have access to the capital as long as it's been preserved."

Even the most conservative investments do not come without some level of risk. Some, for example, are exposed to the risk of inflation.

3. Invest in bonds.

Bonds are a representation of debt. Consequently, purchasing a bond indicates that someone owes you money, which will typically result in you receiving interest on your investment. Investing in safe bonds, such as those issued by the federal government, government agencies, and financially sound corporations, can provide a reliable source of retirement income if they are combined into a properly diversified portfolio. The use of a laddering technique to construct a bond portfolio with a variety of maturities is a smart approach to bond investing.

4. Stocks with a dividend yield of 5% or more

Stocks, as opposed to bonds, represent ownership in a company, and as an owner, you may be entitled to receive dividends on a regular basis, such as once a quarter. dividends are usually paid out in cash to shareholders in the form of a cash payment It should be noted, however, that not all companies pay dividends, and that dividends can be suspended if a company falls into financial difficulties. In addition, the retiree must own the stock in order to receive a dividend, and as a result, the retiree is exposed to market risk. To put it another way, stock prices can sometimes plummet, wiping out any gains made from dividend payments.

Therefore, retirees who buy stocks for income should probably limit their exposure to this strategy and stick with large, stable companies that have a long history of dividend payments on their balance sheet.

Life Insurance is a fifth option.

Despite the fact that life insurance is not intended to be an investment, it can be a welcome source of additional income for retirees who find themselves a little short of funds each month. The safest type of insurance policy for the job is one that accumulates cash value on a schedule, such as whole life or universal life. Policyholders can gain access to their cash reserves by taking out a loan or making a physical withdrawal.

One caveat: If you take out a loan or withdraw money from your policy, your death benefit will be reduced by the same amount. If you are unable to repay your loan, the death benefit payable to your heirs will be used to pay back the loan.

6. Equity in one's home

Alternatively, you could sell your home and use the proceeds to supplement your income, or you could take out a home equity loan, home equity line of credit, or reverse mortgage to use the equity in your home as income. A reliance on the value of your home as a primary source of retirement income, on the other hand, may be dangerous because home values may drop suddenly, reducing or wiping out your home equity.

It may be more appropriate to think of home equity as a backup plan, similar to life insurance.

7. Property with a recurring source of income

Whether you're retired or not, it's nice to receive a monthly check when you rent out a home or sell one to someone and continue to service their mortgage (just like a bank).

However, if the renter or homeowner does not pay you, it is not as enjoyable as it appears. Keep in mind that if you are a landlord, you are responsible for paying property taxes as well as upkeep costs. One option for retirees is to consider renting out their homes on a short-term basis through a home-sharing platform such as Airbnb or VRBO.

The eighth type of investment trust is the real estate investment trust (REITs)

If you like real estate but don't want to be a landlord or a mortgage holder, consider investing in equity real estate investment trusts (REITs), which buy, sell, and manage commercial properties such as shopping malls and apartment complexes.

Mutual funds, which hold a diversified portfolio of securities, are used to purchase REIT shares directly on stock exchanges or indirectly through mutual funds. Real estate investment trusts (REITs) frequently pay large monthly or quarterly dividends.

"Investors have benefited from the diversification benefits that real estate has provided alongside their global stock and bond positions. According to Mark Hebner, founder and president of Index Fund Advisors in Irvine, California, real estate investment trusts (REITs) provide investors with access to a diversified portfolio of both residential and commercial real estate around the world that is highly liquid.

As with regular stocks, real estate investment trusts (REITs) can be volatile, so it's best not to get carried away with them.

Savings accounts and certificates of deposit (CDs)

Bank accounts and certificates of deposit insured by the Federal Deposit Insurance Corporation (FDIC) are the most secure and dependable sources of income (CD).

3 Despite the fact that this strategy will not generate much income when interest rates on CDs and savings accounts are as low as 2 percent or even lower, it can be a good option when rates rise to more attractive levels.

10. Employment on a part-time basis

Retirees frequently desire to remain active and involved in their communities. Workng part-time or on a temporary basis, if you're able to do so, can be a good way to accomplish this while also earning some extra money. If you have a marketable hobby or area of expertise, there are a variety of options for earning money on your own timetable and terms.

And the only thing that's at risk is your spare time, of course.

What's the bottom line?

"Just because you're retired doesn't rule out the possibility of being a long-term investor," says Marguerita M. Cheng, CFP®, CEO of Blue Ocean Global Wealth in Gaithersburg, Maryland. The fact that you have stopped saving for retirement because you are retired does not imply that you no longer need to save for retirement.

The beauty of these ten options is that they can be combined and matched to meet your specific income requirements and risk tolerance. A qualified financial professional can assist you in determining the optimal combination of assets and liabilities.