The Global Semiconductor Intellectual Property (IP) Market has shown substantial growth, valued at USD 7.1 billion in 2023. The market is expected to grow at a compound annual growth rate (CAGR) of 5.9% from 2024 to 2034, reaching a market size of USD 13.5 billion by the end of the forecast period. This robust growth can be attributed to a variety of factors, including the increasing demand for AI-based applications, government initiatives to modernize defense technologies, and the evolving strategies of key industry players.

Analyst Viewpoint: The Role of AI in Shaping the Future of Semiconductor IP

One of the primary drivers of growth in the semiconductor IP market is the rising demand for AI-based applications. AI, and specifically deep learning neural networks, require reliable and proven IP solutions to minimize risk and maximize performance. As industries like automotive, consumer electronics, and the Internet of Things (IoT) increasingly integrate AI into their operations, the demand for customized IP cores continues to rise. This trend is fueling the development of robust chip designs and compute-intensive methodologies, positioning AI as a central force in the expansion of the semiconductor IP market.

Government Initiatives: Strengthening Defense Technologies

In addition to AI, government initiatives to modernize defense technologies are significantly contributing to the growth of the semiconductor IP market. The defense sector relies heavily on semiconductors for the performance of its systems and platforms, creating a demand for advanced hardware requirements in AI System-on-Chips (SoCs). These initiatives have driven research and development in neural network processing (NNP) and deep learning (DL) algorithms, further bolstering the need for high-performance semiconductor IP.

As the defense industry continues to evolve, digital IP plays a critical role in ensuring the security and integrity of sensitive information. Technologies like Hardware Root of Trust (HRoT) and encryption/decryption mechanisms have become essential components of semiconductor IP in defense applications. HRoT, in particular, is gaining traction as a foundational technology for secure computing systems, providing secure storage of keys and certificates, cryptographic operations, and secure boot processes.

Market Introduction: Defining Semiconductor IP

Semiconductor Intellectual Property (SIP), also known as Virtual Components (VCs), refers to the legal rights that protect the creation of new technologies and methodologies in the semiconductor industry. IP can be classified into two main categories: design IP and technology IP. Design IP includes processor IP, system IP, interface IP, and physical IP, while technology IP encompasses process IP and materials IP. These IPs are fundamental to protecting inventions, designs, and symbols used in commerce, making them a crucial aspect of the semiconductor industry.

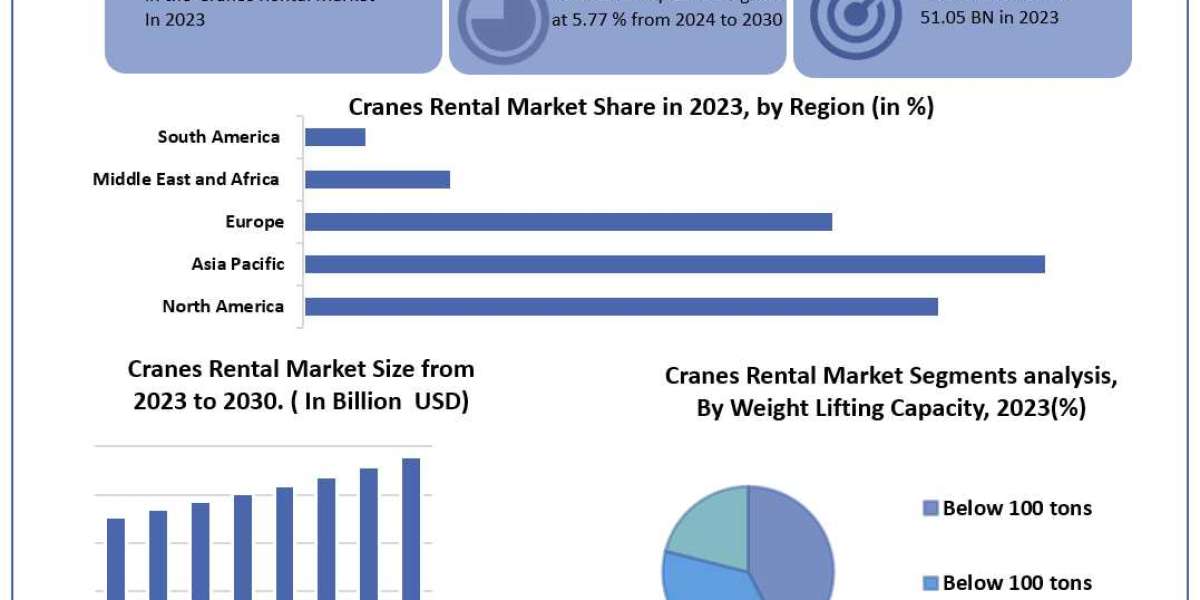

Regional Outlook: North America Leading the Way

Geographically, North America held the largest share of the semiconductor IP market in 2023. This region's dominance is driven by concerns over SIP theft, coupled with increased investment in semiconductor manufacturing. The U.S. government’s “CHIPS and Science Act,” passed in August 2022, aimed to stimulate semiconductor manufacturing activity in the U.S., further boosting the market.

However, Asia Pacific is also emerging as a significant player in the semiconductor IP market. With two-thirds of global semiconductor sales occurring in Asia in 2022, the region has become a hub for semiconductor production. China, in particular, stands out as the largest manufacturer and downstream user of semiconductors, contributing to the region’s growing influence in the global semiconductor IP market.

Key Players and Market Strategies

The semiconductor IP market is characterized by the presence of several key players, including Arm Limited, Rambus, Synopsys, Inc., CEVA, Inc., and Cadence Design Systems, Inc. These companies are increasingly focusing on licensing Application-Specific Integrated Circuit (ASIC) and Field-Programmable Gate Array (FPGA) semiconductor IP solutions. Additionally, they are commercializing captive IP from large semiconductor and systems firms, creating new business models to maximize the value of their IP portfolios.