Supply Chain Finance Market Growth or Demand Increase or Decrease for what contains?

The Supply Chain Finance market is experiencing substantial growth fueled by the increasing complexity of global supply chains and the need for efficient financial solutions. This market segment addresses challenges such as working capital constraints, payment delays, and risk management across supply chain networks. Businesses are increasingly adopting supply chain finance to optimize cash flow, enhance liquidity, and strengthen relationships with suppliers and partners.

Key factors driving market growth include the digital transformation of financial services, which enables faster and more transparent transactions, as well as the integration of technologies like blockchain and AI to mitigate risks and streamline processes. Moreover, as businesses strive for operational resilience and cost efficiency, the demand for innovative supply chain finance solutions is expected to continue rising across various industries worldwide.

Explore additional details by clicking the link provided:https://www.maximizemarketresearch.com/request-sample/168082/

Supply Chain Finance Market CAGR Estimation:

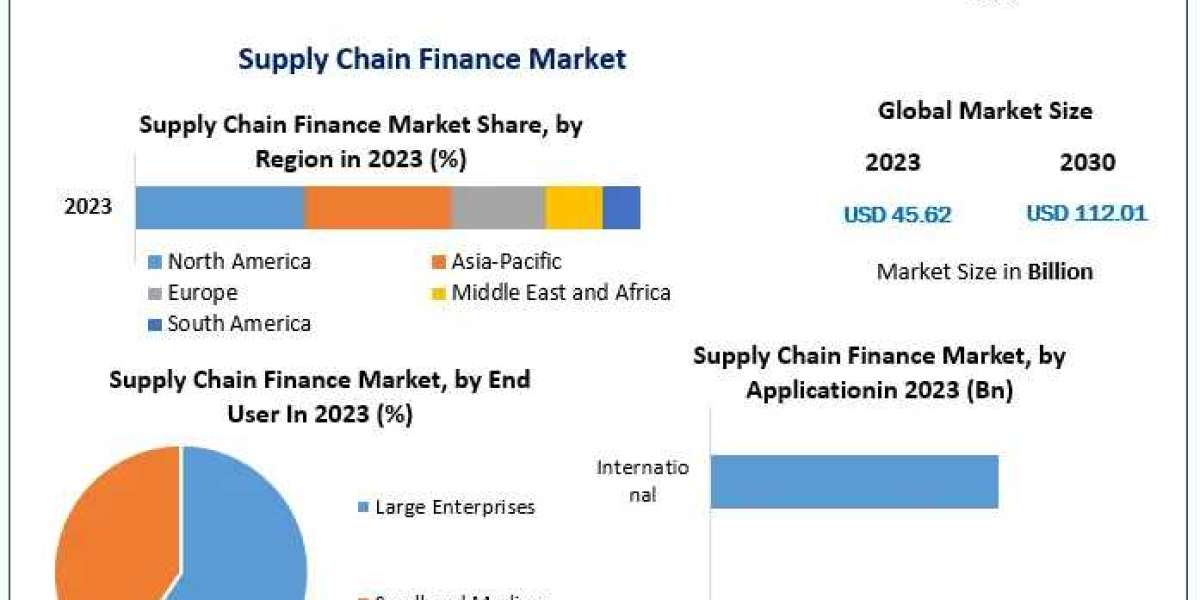

Supply Chain Finance Market was valued at USD 45.62 Billion in 2023 and is expected to reach USD 112.01 Billion by 2030, exhibiting a CAGR of 13.69 % during the forecast period (2024-2030)

Supply Chain Finance Market Segmentation:

by Offering

• Export and Import Bills

• Letter of Credit

• Performance Bonds

• Shipping Guarantees

• Others

by Provider

• Banks

• Trade Finance House

• Others

The banks sector held the largest market share in 2021 with almost 85% of the worldwide supply chain finance market share, and it is expected that it would maintain its leading position over the projected period. Supply chain finance is a group of tech-based finance and business processes that enables all parties involved in a transaction to work together more efficiently and save money. Supply chain finance works best when the buyer can obtain financing at a lower cost and has a better credit rating than the supplier. However, throughout the course of the projected period, the trade finance house market is expected to grow at the highest rate—14%.

by End User

• Large Enterprises

• Small and Medium-sized Enterprises

by Application

• Domestic

• International

With about a quarter of the global market share in 2023, the domestic sector led the supply chain finance market. Over the course of the projection period, it is anticipated that this market segment will continue to hold the bulk of the market share. Over the course of the projected period, the abroad category is expected to see the fastest CAGR of 14.2%.

by Region

• North America

• Europe

• Asia Pacific

• South America

• Middle East Africa

To access more comprehensive information, click here:https://www.maximizemarketresearch.com/request-sample/168082/

Supply Chain Finance Market Overview:

The Maximize Market Research report assists clients in gaining a comprehensive understanding of the competitive landscape, serving as a valuable resource for strategic planning purposes. The comprehensive Supply Chain Finance market overview furnishes extensive information regarding market size, trade statistics, prominent participants, and a range of market indicators, encompassing aspects such as life cycle, prevailing trends, and more.

Supply Chain Finance Market Growth or Demand in which regions??

The growth and demand for supply chain finance solutions are robust across various regions globally, reflecting the widespread adoption of these financial strategies to optimize supply chain operations. North America leads the market, driven by its large and sophisticated supply chain networks in sectors such as manufacturing, retail, and technology. The region's focus on advanced financial technologies and regulatory frameworks supports the adoption of supply chain finance solutions.

Europe follows closely, with countries like the UK, Germany, and France advancing in supply chain finance to improve efficiency and manage working capital effectively. In Asia-Pacific, rapid economic growth, particularly in emerging markets such as China and India, is driving significant demand for supply chain finance to support expanding supply chain networks and facilitate trade finance.

Latin America and the Middle East are also witnessing increasing adoption of supply chain finance solutions, driven by efforts to enhance operational efficiency and mitigate financial risks in supply chain management. Overall, the global supply chain finance market exhibits diverse regional dynamics, with each region contributing to market growth through adoption across various industries and sectors.

Supply Chain Finance Market Scope Methodology:

The competitive landscape of the Supply Chain Finance market encompasses aspects like technology adoption, financial strength, portfolio, mergers and acquisitions, joint ventures, and strategic alliances. A comprehensive report delves into the drivers, limitations, opportunities, and challenges inherent in the Supply Chain Finance market. The report employed a bottom-up approach to ascertain Supply Chain Finance market estimations and growth rates.

To gain insights into Supply Chain Finance market penetration, pricing dynamics, demand analysis, and competitive panorama, the report executed regional analysis at local, regional, and global levels. Essential details about the Supply Chain Finance market, including stakeholders, investors, and new entrants, are presented to facilitate the development of marketing strategies and investment plans.

Both primary and secondary data gathering techniques were employed for the Supply Chain Finance Market. Primary approaches involved surveys, questionnaires, and interviews with industry leaders and business proprietors, while secondary data encompassed sources like press releases, annual and financial reports, white papers, etc. SWOT analysis was leveraged to pinpoint market vulnerabilities and weaknesses, while the PORTER framework was applied to gauge industry competitiveness within the Supply Chain Finance Market.

Click here for a more detailed explanation:https://www.maximizemarketresearch.com/request-sample/168082/

Supply Chain Finance Market Key Players:

• IBM

• Ripple

• Rubix by Deloitte

• Accenture

• Distributed Ledger Technologies

• Oklink

• Nasdaq Linq

• Oracle

• AWS

• Citi Bank

• ELayaway

• HSBC

• Ant Financial

• JD Financial

• Qihoo 360

• Tencent

• Baidu

• Huawei

• Bitspark

• SAP

• ALIBABA

For an in-depth analysis, click the provided link:https://www.maximizemarketresearch.com/market-report/supply-chain-finance-market/168082/

Key questions answered in the Supply Chain Finance Market are:

- What is Supply Chain Finance?

- What is the growth rate of the Supply Chain Finance Market?

- Which are the factors expected to drive the Supply Chain Finance market growth?

- What are the different segments of the Supply Chain Finance Market?

- What are the factors restraining the growth of the Supply Chain Finance Market?

- What is the demand pattern of the Supply Chain Finance Market?

- What major challenges could the Supply Chain Finance Market face in the future?

Related Reports:

Global Phosphate Fertilizer Market https://www.maximizemarketresearch.com/market-report/global-phosphate-fertilizer-market/25781/

Global Sebacic Acid Market https://www.maximizemarketresearch.com/market-report/global-sebacic-acid-market/25330/

Key Offerings:

- Past Market Size and Competitive Landscape

- Past Pricing and price curve by region

- Market Size, Share, Size Forecast by different segment |

- Market Dynamics – Growth Drivers, Restraints, Opportunities, and Key Trends by Region

- Market Segmentation – A detailed analysis by segment with their sub-segments and Region

- Competitive Landscape – Profiles of selected key players by region from a strategic perspective

About Maximize Market Research:

Maximize Market Research is a multifaceted market research and consulting company with professionals from several industries. Some of the industries we cover include medical devices, pharmaceutical manufacturers, science and engineering, electronic components, industrial equipment, technology and communication, cars and automobiles, chemical products and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

Contact Maximize Market Research:

3rd Floor, Navale IT Park, Phase 2

Pune Banglore Highway, Narhe,

Pune, Maharashtra 411041, IndiaC

sales@maximizemarketresearch.com

+91 96071 95908, +91 9607365656