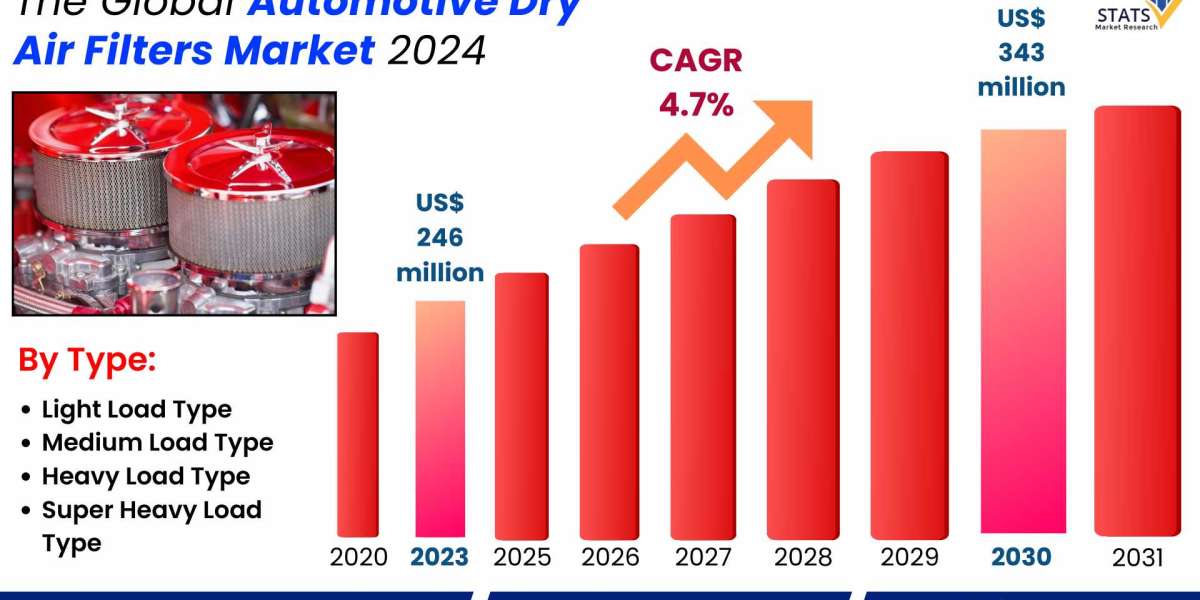

Automotive Dry Air Filters market was valued at USD 246 million in 2023 and is projected to reach USD 343 million by 2030, growing at a Compound Annual Growth Rate (CAGR) of 4.7% during the forecast period (2024-2030).

The U.S. Market is Estimated at $ Million in 2023, While China is Forecast to Reach $ Million.

Light Load Type Segment to Reach $ Million by 2030, with a % CAGR in next six years.

The global key manufacturers of Automotive Dry Air Filters include Donaldson Company, Freudenberg, KN, Mahle, Mann-Hummel, Hengst, Bosch, GVS Group and Parker, etc. in 2023, the global top five players have a share approximately % in terms of revenue.

This report aims to provide a comprehensive presentation of the global market for Automotive Dry Air Filters, with both quantitative and qualitative analysis, to help readers develop business/growth strategies, assess the market competitive situation, analyze their position in the current marketplace, and make informed business decisions regarding Automotive Dry Air Filters. This report contains market size and forecasts of Automotive Dry Air Filters in global, including the following market information:

- Global Automotive Dry Air Filters Market Revenue, 2019-2024, 2025-2030, ($ millions)

- Global Automotive Dry Air Filters Market Sales, 2019-2024, 2025-2030, (K Units)

- Global top five Automotive Dry Air Filters companies in 2023 (%)

Due to their materials and construction, the air flow of even the high-performance dry air filters will usually be less than an oiled filter of the same size. The upside to dry filters is that they require less maintenance. They arent always reusable, since using water to clean them will damage the filter element. Their life can be extended by using compressed air to blow some of the dirt off, but that can only be done so many times. OEM dry filters are generally effective up until 10,000 to 15,000 miles (check your service manual), then they must be replaced. Dry filters are commonly used in vehicles that are driven in drier, dustier climates, where airborne contaminants are way more plentiful than in wetter climates. Many people run dry filters in these environments because there is usually so much dust, that an oiled filter would need to be cleaned constantly.

Automotive dry air filters are essential components in vehicles, designed to clean the air entering the engine by trapping dust, dirt, and other contaminants. They help ensure optimal engine performance, fuel efficiency, and longevity.

Market Segmentation and Key End Users

The automotive dry air filter market can be segmented based on vehicle type, including passenger cars, light commercial vehicles (LCVs), and heavy commercial vehicles (HCVs)

Passenger Cars

- Individual Vehicle Owners: Represent the largest segment in the market. They typically replace air filters during routine maintenance, which usually occurs every 12,000 to 15,000 miles. Approximately 70% of individual car owners prefer dry air filters due to their efficiency and ease of maintenance.

- Aftermarket Service Centers: These service centers cater to a significant portion of the replacement market, with about 60% of customers opting for dry air filters during their visits.

Light Commercial Vehicles (LCVs)

- Small Business Owners: These users, owning fleets of LCVs, prioritize cost-effective maintenance solutions. Dry air filters are favored for their balance of cost and performance, with around 65% of small business fleet managers choosing them.

- Commercial Fleet Operators: Large fleet operators, managing anywhere from dozens to hundreds of LCVs, often standardize the use of dry air filters to streamline maintenance processes. It is estimated that 75% of these operators specify dry air filters in their maintenance schedules.

Heavy Commercial Vehicles (HCVs)

- Logistics and Transportation Companies: These companies rely heavily on the efficiency of dry air filters to maintain the performance and fuel efficiency of their trucks. Roughly 80% of heavy commercial vehicle operators utilize dry air filters, given their ability to handle large volumes of air and contaminants.

- Public Transportation Fleets: Buses and other public transport vehicles frequently use dry air filters due to their reliability and lower long-term costs. About 70% of public transportation fleet managers specify dry air filters in their procurement guidelines.

Market Trends and Consumer Preferences

Increased Adoption of Synthetic Media: Modern dry air filters are increasingly made from synthetic materials, which offer superior filtration and longer lifespan compared to traditional paper filters. Approximately 55% of new dry air filters sold are made from synthetic media.

Environmental Considerations: There is a growing preference for eco-friendly and recyclable air filters. Nearly 40% of consumers now consider the environmental impact of air filters when making their purchase decision.

Technological Advancements: Integration of advanced technologies like nanofiber layers in dry air filters is on the rise. These enhancements improve filtration efficiency without compromising airflow. Around 30% of the market now consists of these high-tech filters.

OEM vs. Aftermarket: Original Equipment Manufacturer (OEM) filters still dominate, with 60% of consumers preferring them for their perceived higher quality and better fit. However, the aftermarket segment is growing, driven by competitive pricing and improved quality standards, capturing 40% of the market.

Increased Adoption of Synthetic Media: Modern dry air filters are increasingly made from synthetic materials, which offer superior filtration and longer lifespan compared to traditional paper filters. Approximately 55% of new dry air filters sold are made from synthetic media.

Environmental Considerations: There is a growing preference for eco-friendly and recyclable air filters. Nearly 40% of consumers now consider the environmental impact of air filters when making their purchase decision.

Technological Advancements: Integration of advanced technologies like nanofiber layers in dry air filters is on the rise. These enhancements improve filtration efficiency without compromising airflow. Around 30% of the market now consists of these high-tech filters.

OEM vs. Aftermarket: Original Equipment Manufacturer (OEM) filters still dominate, with 60% of consumers preferring them for their perceived higher quality and better fit. However, the aftermarket segment is growing, driven by competitive pricing and improved quality standards, capturing 40% of the market.

Regional Insights

- North America: Dominates the market with the highest adoption rate, where nearly 85% of vehicles use dry air filters. The preference is driven by stringent emission norms and a high number of vehicles per capita.

- Europe: Follows closely with an 80% adoption rate, spurred by rigorous environmental regulations and a strong focus on vehicle maintenance.

- Asia-Pacific: Emerging as a significant market with a 70% adoption rate, particularly in China and India, where the automotive industry is rapidly expanding.

MARKET MONITOR GLOBAL, INC (MMG) has surveyed the Automotive Dry Air Filters manufacturers, suppliers, distributors and industry experts on this industry, involving the sales, revenue, demand, price change, product type, recent development and plan, industry trends, drivers, challenges, obstacles, and potential risks.

Total Market by Segment:

Global Automotive Dry Air Filters Market, by Type, 2019-2024, 2025-2030 ($ Millions) (K Units)

Global Automotive Dry Air Filters Market Segment Percentages, by Type, 2023 (%)

- Light Load Type

- Medium Load Type

- Heavy Load Type

- Super Heavy Load Type

Global Automotive Dry Air Filters Market, by Application, 2019-2024, 2025-2030 ($ Millions) (K Units)

Global Automotive Dry Air Filters Market Segment Percentages, by Application, 2023 (%)

- OEM

- Aftermarket

Global Automotive Dry Air Filters Market, By Region and Country, 2019-2024, 2025-2030 ($ Millions) (K Units)

Global Automotive Dry Air Filters Market Segment Percentages, By Region and Country, 2023 (%)

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- France

- U.K.

- Italy

- Russia

- Nordic Countries

- Benelux

- Rest of Europe

- Asia

- China

- Japan

- South Korea

- Southeast Asia

- India

- Rest of Asia

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East Africa

- Turkey

- Israel

- Saudi Arabia

- UAE

- Rest of Middle East Africa

Competitor Analysis

The report also provides analysis of leading market participants including:

- Key companies Automotive Dry Air Filters revenues in global market, 2019-2024 (Estimated), ($ millions)

- Key companies Automotive Dry Air Filters revenues share in global market, 2023 (%)

- Key companies Automotive Dry Air Filters sales in global market, 2019-2024 (Estimated), (K Units)

- Key companies Automotive Dry Air Filters sales share in global market, 2023 (%)

Further, the report presents profiles of competitors in the market, key players include:

- Donaldson Company

- Freudenberg

- KN

- Mahle

- Mann-Hummel

- Hengst

- Bosch

- GVS Group

- Parker

- Shanghai Fleetguard

- Leopard King Group

Chapter 1: Introduces the definition of Automotive Dry Air Filters, market overview.

Chapter 2: Global Automotive Dry Air Filters market size in revenue and volume.

Chapter 3: Detailed analysis of Automotive Dry Air Filters manufacturers competitive landscape, price, sales and revenue market share, latest development plan, merger, and acquisition information, etc.

Chapter 4: Provides the analysis of various market segments by type, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different market segments.

Chapter 5: Provides the analysis of various market segments by application, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different downstream markets.

Chapter 6: Sales of Automotive Dry Air Filters in regional level and country level. It provides a quantitative analysis of the market size and development potential of each region and its main countries and introduces the market development, future development prospects, market space of each country in the world.

Chapter 7: Provides profiles of key players, introducing the basic situation of the main companies in the market in detail, including product sales, revenue, price, gross margin, product introduction, recent development, etc.

Chapter 8: Global Automotive Dry Air Filters capacity by region country.

Chapter 9: Introduces the market dynamics, latest developments of the market, the driving factors and restrictive factors of the market, the challenges and risks faced by manufacturers in the industry, and the analysis of relevant policies in the industry.

Chapter 10: Analysis of industrial chain, including the upstream and downstream of the industry.

Chapter 11: The main points and conclusions of the report.

Table of content

1 Introduction to Research Analysis Reports

1.1 Automotive Dry Air Filters Market Definition

1.2 Market Segments

1.2.1 Market by Type

1.2.2 Market by Application

1.3 Global Automotive Dry Air Filters Market Overview

1.4 Features Benefits of This Report

1.5 Methodology Sources of Information

1.5.1 Research Methodology

1.5.2 Research Process

1.5.3 Base Year

1.5.4 Report Assumptions Caveats

2 Global Automotive Dry Air Filters Overall Market Size

2.1 Global Automotive Dry Air Filters Market Size: 2023 VS 2030

2.2 Global Automotive Dry Air Filters Revenue, Prospects Forecasts: 2019-2030

2.3 Global Automotive Dry Air Filters Sales: 2019-2030

3 Company Landscape

3.1 Top Automotive Dry Air Filters Players in Global Market

3.2 Top Global Automotive Dry Air Filters Companies Ranked by Revenue

3.3 Global Automotive Dry Air Filters Revenue by Companies

3.4 Global Automotive Dry Air Filters Sales by Companies

3.5 Global Automotive Dry Air Filters Price by Manufacturer (2019-2024)

3.6 Top 3 and Top 5 Automotive Dry Air Filters Companies in Global Market, by Revenue in 2023

3.7 Global Manufacturers Automotive Dry Air Filters Product Type

3.8 Tier 1, Tier 2 and Tier 3 Automotive Dry Air Filters Players in Global Market

3.8.1 List of Global Tier 1 Automotive Dry Air Filters Companies

3.8.2 List of Global Tier 2 and Tier 3 Automotiv

CONTACT US:

276 5th Avenue, New York, NY 10001, United States

International: +1(646)-781-7170 / +91 8087042414

Similar Reports:

Automotive Engine Intake Air Filters Market, Global Outlook and Forecast 2024-2030

Global Automotive Fuel Filters Market Research Report 2024(Status and Outlook)

Electromagnetic Pulse (EMP) Filters for Automotive and Defense Market, Global Outlook and Forecast 2023-2030

Automotive Noise Filters Market, Global Outlook and Forecast 2023-2032