The global Micro-Electromechanical System (MEMS) market, valued at $17.7 billion in 2023, is poised for significant growth. With an estimated CAGR of 4.4% from 2024 to 2034, the market is projected to reach $28.6 billion by 2034. This growth is driven by advancements in the healthcare sector and an increasing demand for consumer electronics.

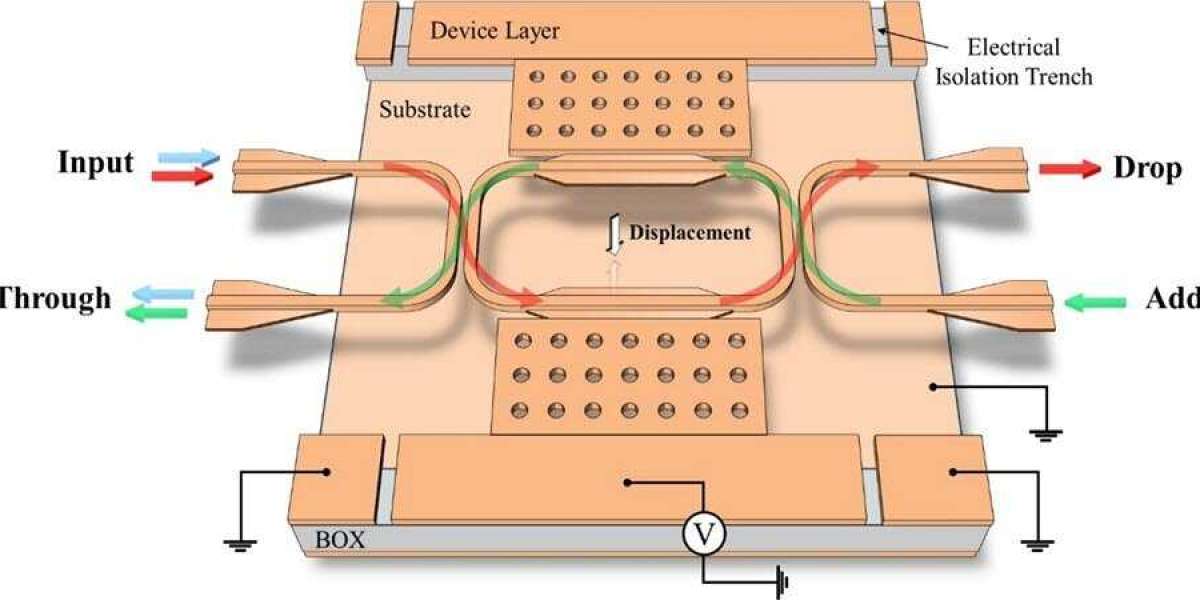

MEMS technology, which integrates mechanical and electrical components at a microscopic scale, is transforming various industries. Typically, MEMS components range from 1 to 100 micrometers, while devices span 20 micrometers to a millimeter. These systems consist of a central processing unit and several interactive components, enabling devices to sense and respond to environmental factors such as motion, pressure, temperature, and chemical composition.

Key Market Drivers

Healthcare Innovations

The healthcare sector is witnessing a surge in innovative solutions utilizing MEMS technology, especially in biomedical applications. The rise in non-communicable diseases and the growing healthcare needs of an aging population are propelling the adoption of MEMS devices. These devices, due to their small size and high production capabilities, are ideal for point-of-care testing and disposable testing devices to prevent infectious diseases. For instance, MEMS technology enables accurate bedside testing using just a drop of blood or urine, enhancing the efficiency and accessibility of medical diagnostics.

Consumer Electronics Boom

The consumer electronics market is a significant contributor to the MEMS market growth. MEMS technology is integral to products like smartphones, wearables, and other electronic devices, offering enhanced performance at high frequencies. The transition from traditional sensors to MEMS-based sensors in these devices is notable. Applications such as accelerometers and gyroscopes in smartphones rely heavily on MEMS for functionalities like electronic image stabilization (EIS) and optical image stabilization (OIS).

According to the Ericsson Mobility Report 2022, the proliferation of 5G technology is further amplifying the demand for MEMS in consumer electronics. The report highlights that over 1 billion 5G subscriptions were recorded in 2022, with substantial growth in 4G subscriptions as well. This trend underscores the increasing integration of MEMS technology in smart mobile devices.

Regional Insights

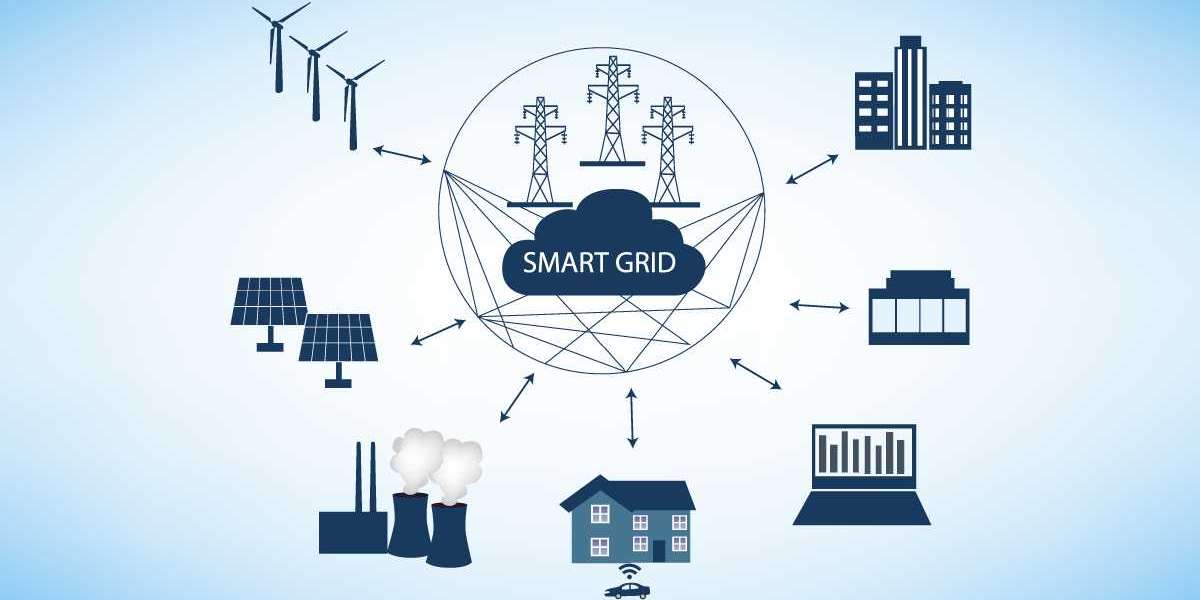

The Asia Pacific region dominated the MEMS market in 2023, driven by the high penetration of smartphones, 5G networks, and the demand for smart consumer electronics and wearables. The region's prominence in the automotive, consumer electronics, and industrial equipment sectors also fuels market growth. Automotive manufacturers are increasingly incorporating MEMS to enhance the efficiency and performance of electric vehicles (EVs), responding to emission regulations and consumer demands.

Get Sample PDF Copy: https://shorturl.at/tHNSK

Key Players and Market Strategies

Leading companies in the MEMS market include Analog Devices, Inc., Broadcom, Goertek Microelectronics Inc., Honeywell International Inc., Infineon Technologies AG, and others. These companies are focused on developing innovative sensor technologies to cater to the rising demand in various industries, particularly consumer electronics.