Download FREE Sample of this Report @ https://www.statsmarketresearch.com/download-free-sample/7959496/global-digital-security-lens-forecast-2024-2030-373

Rising Demand for Digital Security Solutions: The increasing need for surveillance and security measures in various sectors such as commercial, residential, industrial, and governmental is driving the demand for digital security lenses.

Advancements in Surveillance Technology: Continuous advancements in surveillance technology, including higher resolution cameras, improved image processing algorithms, and enhanced connectivity options, are driving the adoption of digital security lenses.

Applications: Digital security lenses find applications in closed-circuit television (CCTV) systems, video surveillance cameras, access control systems, and other security monitoring devices.

Technological Features: Digital security lenses offer features such as high-definition imaging, wide dynamic range, low-light performance, zoom capabilities, and remote monitoring, enhancing their effectiveness in security applications.

Market Segmentation: The market can be segmented based on lens types (fixed focal length, varifocal, zoom), application areas (indoor, outdoor, day/night surveillance), and end-user industries (commercial, residential, government, industrial).

Regional Dynamics: Market growth may vary across regions based on factors such as urbanization, crime rates, government regulations, and infrastructure development.

Competitive Landscape: The market is characterized by the presence of established players in the security and surveillance industry, as well as niche manufacturers specializing in digital imaging technologies.

Challenges: Challenges such as concerns over privacy, data security, and the proliferation of counterfeit products may pose obstacles to market growth.

Market Opportunities: Emerging opportunities in sectors such as smart cities, transportation, critical infrastructure, and retail security present avenues for market expansion and product innovation in the digital security lens market.

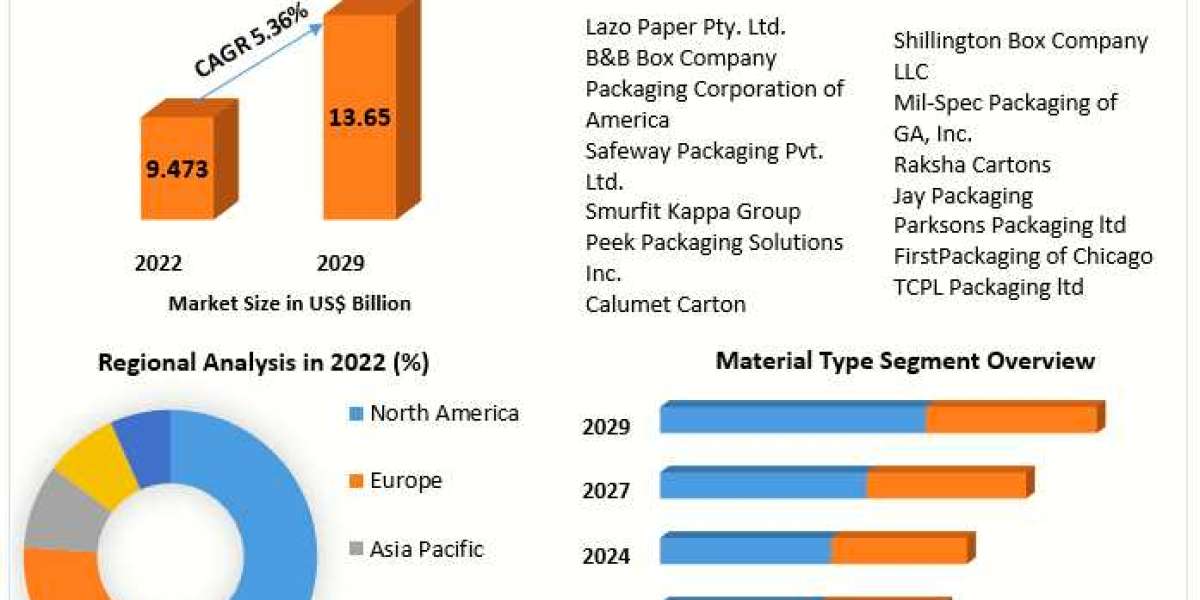

The USA market for Global Digital Security Lens market is estimated to increase from USD million in 2023 to reach USD million by 2030, at a CAGR during the forecast period of 2023 through 2030.

The China market for Global Digital Security Lens market is estimated to increase from USD million in 2023 to reach USD million by 2030, at a CAGR during the forecast period of 2023 through 2030.

The Europe market for Global Digital Security Lens market is estimated to increase from USD million in 2023 to reach USD million by 2030, at a CAGR during the forecast period of 2023 through 2030.

Digital security has become a cornerstone of modern technology, affecting individuals, businesses, and governments alike. With the increasing frequency and sophistication of cyber-attacks, it is crucial to understand the key statistics that shape our digital security landscape. This report delves into the latest figures and trends that highlight the current state of digital security.

1. Cyber Attacks on the Rise: In 2023, the global volume of cyber-attacks saw an alarming increase of 25% compared to the previous year. This surge reflects the growing capabilities of cybercriminals and the expanding attack surface due to the proliferation of connected devices.

2. Financial Impact: The financial repercussions of cybercrime are staggering. In 2023, the global cost of cybercrime is estimated to have reached $10.5 trillion annually, up from $3 trillion in 2015. This figure underscores the massive economic burden posed by cyber threats.

3. Data Breaches: Data breaches continue to be a significant concern. In the first half of 2023 alone, there were over 1,200 reported data breaches, exposing more than 22 billion records. Personal data, including names, addresses, and financial information, remains a prime target for attackers.

4. Ransomware Epidemic: Ransomware attacks have become increasingly prevalent and costly. In 2023, ransomware incidents rose by 15%, with the average ransom payment exceeding $800,000. Additionally, the total damage costs associated with ransomware are predicted to reach $20 billion by the end of the year.

5. Phishing Scams: Phishing remains one of the most common and effective methods of cyber-attack. In 2023, phishing attacks accounted for more than 90% of all cyber incidents. Notably, spear-phishing attacks, which target specific individuals or organizations, increased by 20%.

6. Security Budgets: In response to escalating threats, organizations are significantly increasing their cybersecurity budgets. On average, companies are allocating 12–15% of their IT budgets to cybersecurity, up from 8–10% five years ago. This investment is crucial for implementing advanced security measures and safeguarding sensitive information.

7. Cloud Security: With the rapid adoption of cloud services, cloud security has become a top priority. In 2023, 94% of enterprises reported concerns about cloud security, and 67% experienced a cloud-based data breach. As a result, spending on cloud security solutions is projected to grow by 22% annually.

8. Insider Threats: Insider threats, whether malicious or accidental, pose a significant risk to organizations. In 2023, insider-related incidents accounted for 34% of all data breaches. This statistic highlights the importance of robust internal security policies and employee training programs.

9. Regulatory Compliance: Regulatory frameworks are evolving to keep pace with the digital security landscape. By 2023, more than 120 countries had enacted data protection and privacy laws. Compliance with these regulations is essential for organizations to avoid hefty fines and reputational damage.

10. Emerging Technologies: Emerging technologies, such as artificial intelligence (AI) and machine learning (ML), are playing a crucial role in enhancing digital security. In 2023, 75% of organizations reported using AI and ML to detect and respond to cyber threats more effectively.

The U.S. Market is Estimated at $ Million in 2023, While China is Forecast to Reach $ Million.

Zoom Ratio: Less Than 10 Times Segment to Reach $ Million by 2030, with a % CAGR in next six years.

The global key manufacturers of Digital Security Lens include Tarmon, Fuji Photo Film, CBC Co., VS Technology, YOUNG OPTICS, KINKO OPTICAL, Jiaxing Zmax Optech, Union Optech and Sunny Optical Technology, etc. in 2023, the global top five players have a share approximately % in terms of revenue.

The digital security lens is the eye for the front end of the security video surveillance to realize the shooting and identification of the external environment.

This report aims to provide a comprehensive presentation of the global market for Digital Security Lens, with both quantitative and qualitative analysis, to help readers develop business/growth strategies, assess the market competitive situation, analyze their position in the current marketplace, and make informed business decisions regarding Digital Security Lens. This report contains market size and forecasts of Digital Security Lens in global, including the following market information:

- Global Digital Security Lens Market Revenue, 2019–2024, 2025–2030, ($ millions)

- Global Digital Security Lens Market Sales, 2019–2024, 2025–2030, (K Units)

- Global top five Digital Security Lens companies in 2023 (%)

Total Market by Segment:

Global Digital Security Lens Market, by Type, 2019–2024, 2025–2030 ($ Millions) (K Units)

Global Digital Security Lens Market Segment Percentages, by Type, 2023 (%)

- Zoom Ratio: Less Than 10 Times

- Zoom Ratio: 10–30 Times

- Zoom Ratio: Higher Than 30 Times

Global Digital Security Lens Market, by Application, 2019–2024, 2025–2030 ($ Millions) (K Units)

Global Digital Security Lens Market Segment Percentages, by Application, 2023 (%)

- Commercial

- Household

- Transportation

- Other

Global Digital Security Lens Market, By Region and Country, 2019–2024, 2025–2030 ($ Millions) (K Units)

Global Digital Security Lens Market Segment Percentages, By Region and Country, 2023 (%)

- North America (United States, Canada, Mexico)

- Europe (Germany, France, United Kingdom, Italy, Spain, Rest of Europe)

- Asia-Pacific (China, India, Japan, South Korea, Australia, Rest of APAC)

- The Middle East and Africa (Middle East, Africa)

- South and Central America (Brazil, Argentina, Rest of SCA)

Competitor Analysis

The report also provides analysis of leading market participants including:

- Key companies Digital Security Lens revenues in global market, 2019–2024 (Estimated), ($ millions)

- Key companies Digital Security Lens revenues share in global market, 2023 (%)

- Key companies Digital Security Lens sales in global market, 2019–2024 (Estimated), (K Units)

- Key companies Digital Security Lens sales share in global market, 2023 (%)

Further, the report presents profiles of competitors in the market, key players include:

- Tarmon

- Fuji Photo Film

- CBC Co.

- VS Technology

- YOUNG OPTICS

- KINKO OPTICAL

- Jiaxing Zmax Optech

- Union Optech

- Sunny Optical Technology

- Fujian Forecam

- Xiamen Leading Optics

Outline of Major Chapters: Chapter 1: Introduces the definition of Digital Security Lens, market overview.

Chapter 2: Global Digital Security Lens market size in revenue and volume.

Chapter 3: Detailed analysis of Digital Security Lens manufacturers competitive landscape, price, sales and revenue market share, latest development plan, merger, and acquisition information, etc.

Chapter 4: Provides the analysis of various market segments by type, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different market segments.

Chapter 5: Provides the analysis of various market segments by application, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different downstream markets.

Chapter 6: Sales of Digital Security Lens in regional level and country level. It provides a quantitative analysis of the market size and development potential of each region and its main countries and introduces the market development, future development prospects, market space of each country in the world.

Chapter 7: Provides profiles of key players, introducing the basic situation of the main companies in the market in detail, including product sales, revenue, price, gross margin, product introduction, recent development, etc.

Chapter 8: Global Digital Security Lens capacity by region country.

Chapter 9: Introduces the market dynamics, latest developments of the market, the driving factors and restrictive factors of the market, the challenges and risks faced by manufacturers in the industry, and the analysis of relevant policies in the industry.

Chapter 10: Analysis of industrial chain, including the upstream and downstream of the industry.

Chapter 11: The main points and conclusions of the report.

Get the Complete Report TOC @ https://www.statsmarketresearch.com/global-digital-security-lens-forecast-2024-2030-373-7959496

Table of content

1 Introduction to Research Analysis Reports

1.1 Digital Security Lens Market Definition

1.2 Market Segments

1.2.1 Market by Type

1.2.2 Market by Application

1.3 Global Digital Security Lens Market Overview

1.4 Features Benefits of This Report

1.5 Methodology Sources of Information

1.5.1 Research Methodology

1.5.2 Research Process

1.5.3 Base Year

1.5.4 Report Assumptions Caveats

2 Global Digital Security Lens Overall Market Size

2.1 Global Digital Security Lens Market Size: 2023 VS 2030

2.2 Global Digital Security Lens Revenue, Prospects Forecasts: 2019–2030

2.3 Global Digital Security Lens Sales: 2019–2030

3 Company Landscape

3.1 Top Digital Security Lens Players in Global Market

3.2 Top Global Digital Security Lens Companies Ranked by Revenue

3.3 Global Digital Security Lens Revenue by Companies

3.4 Global Digital Security Lens Sales by Companies

3.5 Global Digital Security Lens Price by Manufacturer (2019–2024)

3.6 Top 3 and Top 5 Digital Security Lens Companies in Global Market, by Revenue in 2023

3.7 Global Manufacturers Digital Security Lens Product Type

3.8 Tier 1, Tier 2 and Tier 3 Digital Security Lens Players in Global Market

3.8.1 List of Global Tier 1 Digital Security Lens Companies

3.8.2 List of Global Tier 2 and Tier 3 Digital Security Lens Companies

4 Sights by Product

4.1 Overview

4.1.

Customize/Section/Part Purchase @ https://www.statsmarketresearch.com/chapters-purchase/7959496/global-digital-security-lens-forecast-2024-2030-373

CONTACT US:

276 5th Avenue, New York, NY 10001, United States

International: +1(646)-781–7170 / +91 8087042414